COVID-19 short-time work in the Czech Republic should help companies to protect their jobs. Czech Kurzarbeit

“Antivirus“ as a Czech COVID-19 short-time measure – Kurzarbeit in Czech Republic extended until the end of August 2020

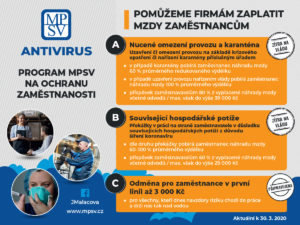

On March 19, 2020 the Czech government has approved a proposal of the Czech Minister of Labor and Social Affairs (MSPV) to help Czech workers and employers mitigate the effects of the COVID-19 epidemic. “Antivirus“ as job protection program in the Czech Republic is a measure for the Czech Labour Offices to compensate wages. This measure will help employers to manage better the current situation so that employers do not have to do layoffs.

On June 8, 2020, the Czech government approved a proposal submitted by the Ministry of Labor and Social Affairs to extend the Antivirus program until the end of August 2020, i.e. until August 31, 2020, both in option A and option B. The reason for this extension is mainly the current epidemiological situation and short-time government measures that have persisted so far, as a result of which some labor sectors are still stagnant (e.g. trade fairs, cultural festivals, etc.). The government has also approved a bill, that would, after it is passed through the Czech Parliament, start providing support to employers also in option C, i.e. the waiver of social security contributions paid by employers for their employees. Specific information and conditions of option C according to the currently discussed bill can be found below in this article.

Terms of the original version of Antivirus program dated March 19 as amended on March 23, 2020

To which employer should have been the benefit granted?

The allowance is granted to employers whose economic activity is at risk from the spread of the disease COVID-19 if it can be shown that the obstacle to work was caused by the COVID-19 infection. The contribution is provided for the full or partial payment of wages for employees due to an obstacle on the part of the employee (quarantine order) or the employer (obstacle - closure of the facility due to the official order to close the company).

Who will pay the allowance?

The allowance is provided by the Labor Office of the Czech Republic. The amount and duration of the provision depend on the reason for the obstacles.

Types of measures under the “Antivirus” program

The following measures A to C, which were extended on March 23, 2020 by the measures D and E should have been activated immediately:

Option A - Ordered quarantine for workers. The compensatory wages and salaries are paid to employees in the amount of 60% of the average wage base. The employer receives a contribution in full of the wages paid.

Option B - Impossibility of work instructions to workers because of emergency measures. The employer was ordered to cease operations based on the government decision on the emergency measures related to COVID-19. The compensatory wages and salaries are paid to the employee in the amount of 100%. The employer receives a contribution equal to 80% of the salary paid.

Option C - Inability to assign work to employees due to quarantine or childcare for a significant proportion of employees. A significant part is meant in particular 30% of employees of companies, establishments or other organizational part according to the employer's operational situation. Wage or salary compensation paid to employees in the amount of 100%. The employer will receive a contribution equal to 80% of the wage compensation paid.

Option D - Restricting the availability of inputs (raw materials, products, services) necessary for the employer's activity as a result of quarantine measures (or generally production failures) at the supplier, including abroad. For example, there is an agreement proving the origin of inputs, bans on actions or taking other measures demonstrably affecting supplies to the employer. Wage or salary compensation paid to employees in the amount of 80%. The employer will receive a contribution equal to 50% of the wage compensation paid.

Option E - Reducing demand for employer's services, products and other products as a result of quarantine measures at the employer's point of sale (CR and abroad). Compensation of wages or salaries paid to employees at least 60%. The employer will receive a contribution equal to 50% of the wage compensation paid.

New version of Antivirus Kurzarbeit COVID-19 in Czech Republic as of March 30, 2020

On March 30, 2020, instead of activating the above-mentioned programs, after criticism from a number of employers, a modified proposal was published, which was discussed on March 31, 2020 at the Government of the Czech Republic and approved as Government Resolution No. 353 of 31 March 2020 on Targeted Employment Support Program and Cancellation of Government Resolution No. 257 of March 19, 2020, Government Resolution No. 293 of March 23, 2020.

On April 1, 2020 the Czech Ministry of Labor and Social Affairs published on its website the Employer Manual - Targeted Employment Support Program "Antivirus". The updated version 2 of the manual can be downloaded on the web site of the Czech Ministry of Labor and Social Affairs published on its website the Employer Manual - Targeted Employment Support Program "Antivirus"- Version 2.

New Antivirus program as Kurzarbeit in the Czech Republic as of March 31, 2020

Detailed information on the Czech Antivirus COVID-19 Kurzarbeit program, including the application form and electronic form, is available from April 6, 2020 on the new website of the Czech Ministry of Labour and Social Affairs Antivirus MPSV - Are you here for the first time? Ask for a contribution to wage compensation and then Have you already signed an agreement? Submit a monthly bill of wage compensation paid. Therefore, the procedure takes place in two stages, i.e. the agreement must first be concluded and only then the contribution can be claimed.

To whom and under what conditions will the compensation be due?

Compensation will be granted to employers whose economic activity will be jeopardized by the spread of the COVID-19 disease, in whole or in part. A contribution will be granted for the full or partial payment of wage compensation due to employees due to an obstacle on the part of the employee (quarantine order) or the employer (obstacle - closure of the establishment due to government order to close operations), if it is proven that the work obstacle was due to infection COVID-19.

In order to qualify for compensation, several conditions will have to be met:

• The employer strictly adheres to the Czech Labor Code;

• The employee must not be on notice and not dismissed;

• It concerns companies in the corporate sector, employees must be in employd and participate in health and pension insurance;

• The employer must pay the salary and pay the taxes.

Who will pay the contribution and how long?

The contribution will be provided by the Labor Office of the Czech Republic. The amount and duration of the provision will depend on the reason for the obstacle at work, for each employee it will be necessary to distinguish the reason for the obstacle at work.

What concrete measures will be implemented and what situations do they respond to?

The amount of compensation paid to employers will be derived from the average super-gross wage, including mandatory contributions (CZK 48,400) and will depend on the reasons why they had to put the employees in an obstacle to work. Employers will be able to apply to the Czech Labor Office for a contribution in two modes:

Option A - type of obstacle:

• in the case of quarantine, the employee receives wage compensation of 60% of the average reduced earnings;

• in case of closure of the operation by a government order, the employee receives 100% wage compensation.

Option B - type of obstacle:

• Barriers to work on the part of the employer due to quarantine or childcare for a significant proportion of employees (30% or more) - the employee receives 100% of the average wage compensation

• Restricting the availability of inputs (raw materials, products, services) necessary for the activity - the employee receives a wage compensation of 80% of the average earnings

• Reduction of demand for services, products and other products of the company - employee receives wage compensation 60% of average earnings.

Amount of contribution under Option A

The amount of the contribution is 80% of the wage compensation, including the contributions paid by the employer to the employee for the duration of the obstacles to work. Thus, the employer shall indicate in the statement of the amount of wage compensation paid and the part of the statutory levies that corresponds to the amount of compensation paid. The contribution of Czech Labour Office is then 80% of the sum of these sums. The maximum monthly amount of the contribution per employee is CZK 39,000.

Amount of contribution under Option B

The amount of the contribution is 60% of the wage compensation, including the contributions paid by the employer to the employee for the duration of the obstacles to work. Thus, the employer shall indicate in the statement of the amount of wage compensation paid and the part of the statutory levies that corresponds to the amount of compensation paid. The contribution of Czech Labour Office is then 60% of the sum of these sums. The maximum monthly amount of the contribution per employee is CZK 29,000.

When should the employer apply for compensation?

Antivirus Kurzarbeit is scheduled to start on April 6, 2020. From then on, applications will be possible. The Czech Ministry of Labour and Social Affairs assumes that there will be a delay of only a few days between the submission of an application and the payment of contributions by the Czech Labor Office.

How to apply?

The exact terms and procedures will be posted on the website later the first week in April. The submission of applications for all the above-mentioned contributions will be completely electronic and therefore contactless. Thus, employers do not have to call individual labor offices or go to the Czech Labor Office contact office. All necessary information will be on the website of the Czech Ministry of Labour and Social Affairs and the Czech Labor Office. There will be also a chatbot on the site, which will be programmed to answer questions related to the program.

When should the employer apply for compensation?

The implementation of the aid should be set up so that the employer will request reimbursement of wage compensation paid after the end of the reporting period, ie after the end of the calendar month for which it is applying for the contribution. For the month of March 2020, the employer will therefore submit an application at the beginning of April 2020. Detailed information on the use of the aid, including the application, will be published later the first week of April.

New Antivirus program as amended on 8.6.2020 proposed the new option C for the employers

On June 8, 2020, the government of the Czech Republic also approved the bill, which introduces the so-called option C of the Antivirus program, which was already included in the original proposal of the Antivirus program from March 2020, but which was not implemented in the end, and since March 2020, the employer could apply only for the contributions under the option A and option B.

The option C takes the form of a law, which shall be passed in the Czech Parliament in the abbreviated legislative procedure. The bill was submitted to the Czech Chamber of Deputies under Chamber of Deputies Press No. 875/0: The government proposal on the bill on insurance on social security and the contribution to the state employment policy paid by some employers as taxpayers in connection with extraordinary measures during the epidemic in 2020. The bill was approved by the Czech Chamber of Deputies on May 29, 2020, and subsequently forwarded to the Senate of Czech Republic. The Senate returned the bill to the Czech Chamber of Deputies with several amendments on June 10, 2020. This amended bill has not yet been included on the agenda of the Chamber of Deputies, but it can be assumed that it will be discussed in an abbreviated regime as soon as possible.

Option C, according to the proposed bill, gives the employers employing up to 50 employees right to the waiver of social security contributions for their employees, and forgives that part of the social security contributions paid by those employers for their employees. The proposed bill envisages the waiver of social security contributions for June, July and August 2020. The contribution should be provided in the form of a reduction in the employer's assessment base. The proposed bill sets a limit for the assessment base per employee to the 1.5 times the average wage set in accordance with Czech Act No. 589/1992 Coll., on Social Security and Contributions to the State Employment Policy (i.e. with a current average wage of CZK 34,835, the wage limit would be CZK 52,252). If the employee's assessment base exceeds this limit, the contributions will be waived only from the part of the salary that falls within the limit of CZK 52,253.

Conditions for participation in the Antivirus program in option C

All employers who meet the following conditions for at least one month (June, July, August) shall be entitled to a waiver of social security contributions for their employees:

1. The employer shall employ a maximum of 50 employees who are covered by social insurance; the number of employees shall be ascertained on the last day of each month; i.e. at the end of June, July and August;

2. The employer shall not dismiss more than 10 % of its employees, while maintaining at least 90% of the total wage bill compared to March 2020; i.e. for each moth, it shall be assessed separately whether the number of employees and the amount of total wage bill for the month for which the waiver is applied for is not lower by more than 10% compared to the March 2020;

3. The employer shall pay insurance contributions for its employees on time, and shall not draw funds from the Antivirus program in option B, which covers the obstacles to work on the part of the employer, in the relevant calendar month.

Kurzarbeit and Kurzarbeitgeld in Germany and Austria

If you are interested in how Kurzarbeit currently works in the country of origin, i.e. in Germany, where its history dates back to 1910, you can read the current summary on the website of German colleagues Kurzarbeitergeld: Was müssen Arbeitgeber wissen? a Corona-Hilfen für Arbeitgeber: Erleichterungen beim Kurzarbeitergeld und mehr. The modified COVID-19 Kurzarbeit was also introduced in Austria, and more detailed conditions are described by Austrian colleagues in the article Hilfspaket für Österreich.

For more information, contact us at:

JUDr. Mojmír Ježek, Ph.D.

ECOVIS ježek, advokátní kancelář s.r.o.

Betlémské nám. 6

110 00 Praha 1

e-mail: mojmir.jezek@ecovislegal.cz

www.ecovislegal.cz

About ECOVIS ježek advokátní kancelář s.r.o.

The Czech law office in Prague ECOVIS ježek practices mainly in the area of Czech commercial law, Czech real estate law, representation at Czech courts, administrative bodies and arbitration courts, as well as Czech finance and banking law, and provides full-fledged advice in all areas, making it a suitable alternative for clients of international law offices. The international dimension of the Czech legal services provided is ensured through past experience and through co-operation with leading legal offices in most European countries, the US, and other jurisdictions. The Czech lawyers of the ECOVIS ježek team have many years of experience from leading international law offices and tax companies, in providing legal advice to multinational corporations, large Czech companies, but also to medium-sized companies and individual clients. For more information, go to www.ecovislegal.cz/en.

The information contained on this website is a legal advertisement. Do not consider anything on this website as legal advice and nothing on this website is an advocate-client relationship. Before discussing anything about what you read on these pages, arrange a legal consultation with us. Past results are not a guarantee of future results, and previous results do not indicate or predict future results. Each case is different and must be judged according to its own circumstances.